With around 400 stores in Japan alone, and another 300 operating internationally, housewares brand Muji shows no signs of slowing its rapid clip of expansion. For the past 35 years, the company has unwaveringly remained faithful to its philosophy of functional, quality design offered at a reasonable price and plans to stay the course for the next 35 years. But in a climate that constantly celebrates novelty, how can Muji continue to thrive?

I'm a huge Muji fan and love the work of both Naoto Fukusawa and Kenya Hara. I think there is so much to be learned from them not just in designing for the real world but as we build digital solutions. What is just enough?

from Archinect by Archinect // preview Zaha Hadid Wins Japan National Stadium Design Competition +Tag Japan’s Sport Council on Thursday awarded a contract to design and construct a centerpiece, billion-dollar national stadium that forms a key part of Tokyo’s bid to host the 2020 Olympic Games to lauded U.K. firm Zaha Hadid Architects.

The Nestrest is a new outdoor hanging pod designed by Daniel Pouzet + Fred Frety for Dedon. This has got to be one of the coolest pieces I've ever seen. I'm not sure why the guy reading the book above isn't soaking wet ... maybe he's been in there for days. I know if I had one I would never leave.

Braun is a storied brand in the world of industrial design-- thanks to a golden era of work from Dieter Rams in the 50's and 60's. Many of his works are in the Moma and you can check out a great background piece on him here.

It's been a while though since I've interesting work from Braun, but this new watch designed in collaboration with sister company, luxury brand Ventura is pretty hot. It borrows the patented scroll bar and digital display font from the much more expensive Ventura line. Approximate price for this watch could be up to USD 600. You can see more at WristFashion.

Also, if you are not familiar, check out some of these classic Braun watch designs from Dieter Ram.

The Porsche 911 first debuted in 1963 and has endured as one of the flyest cars of all time. From and aesthetic point of view, I much prefer the classics to the late model 911s, but the performance and technology specs of a modern 911 Turbo S are in a whole different galaxy.

Enter the Singer Porsche 911. This car gives you the best out of both worlds – classic design and modern performance. Built upon an early '90s-era 911, the new Singer has a carbon fiber body reminiscent of a Porsche from the '70s or '80s, while boasting three modern engines, ranging from 3.6 L to 3.9L with power up to 425 hp. Throw on some 60's inspired aluminum 17-inch wheels, a bespoke interior to match the retro exterior, and a classic Carrera RS steering wheel from 1973 and you've got what may be my favorite car out there.

\

Turnbull Griffin Haesloop designed the Sea Ranch residence in Sea Ranch, California. Description from the architects: The site for this small Sea Ranch house is edged with mature evergreen trees and opens to a meadow with views out to the Pacific Ocean. The clients wanted an understated, flowing house that captured their love of Japanese simplicity. Our solution starts with a vernacular barn form and carves away to shape an exterior octagonal deck that opens to the meadow and the view. A continuous band of windows and doors follow the outline of the cutout to capture the panoramic views. Cedar ceilings and sheetrock walls create a clean minimalist interior, and the window wall features exposed wood framing and structural steel. Visit the Turnbull Griffin Haesloop website – here. Photography by David Wakely .

The late great Dennis Hopper was good at a lot of things: acting, directing, and screenwriting to name a few. He was also quite a photographer.Dennis Hopper: Photographs 1961-1967 ($45) celebrates his prowess behind a still camera with a carefully curated selection of photos taken on movie sets, bars, parties, dinners, and anywhere else he saw a moment worth capturing, which often included some rather well-known subject.

from Design You Trust

Thomas Birke’s urban photography really makes cities come to life.

More Photography by Thomas Birke

by

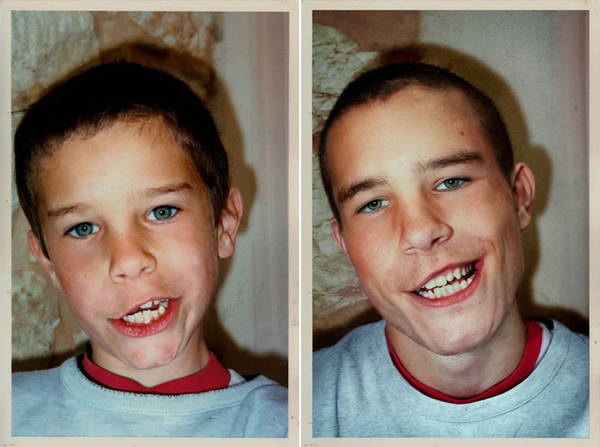

Irina Werning's "Back to the Future" project asks adults to visit the sites of their cherished childhood snapshots and recreate them with matching clothes and facial expressions. The effect ranges from adorkable to heartwarming, with all the shades in between. Shown here: "NICO IN 1990 & 2010, France."

Back to the Future (via Reddit)

Brian Donnelly, more commonly known as KAWS, has become one of our culture’s most storied artists and designers. From his graffiti roots and re-appropriation of art in public spaces, the New-York based creative took a slow and calculated route towards his work. With increasingly large projects under his belt in a more mainstream realm, he has still maintained a notable degree of humbleness through it all. While most of his public image may be that of a serious individual, beneath it all lies a truly interesting and fun personality who has come to make his mark through painting, fashion and toys.

In his recent exhibition in Hong Kong titled “Passing Through”, he unveiled a massive 5 meter version of his popular Companion character, as well as showing a collection of all-new artwork. As an artist first and foremost, we spoke with him regarding his artwork and the planning of the event, as well as interviewing a major cornerstone of the project, SK Lam of AllRightsReserved.

The “Passing Through” exhibition will run until October 24th, 2010.

Harbour City 3 – 27 Canton Road Tsim Sha Tsui, Kowloon Hong Kong

Good lord! This new Fuji FinePix X100 currently in preview at Photokina looks SO good that I almost don't care that it's packing an APS-C sensor and both a high-res LCD viewfinder and an actual optical viewfinder. This looks to be the camera that I wish my Sigma DP2 was.

It will hit the shelves in Spring 2011 and retail for about $1k ... so put your GF1 on ebay suckas.

Tongue is out, drool is in effect.

The house was built in the Minija Valley in Lithuania. A-ma-zing! The canitliver and the car port below are out of control ... I'd be freaking out everytime I drove in there ("please don't fall on me").

By Larry Dignan | July 29, 2010, 2:32am PDT

Summary

On Netflix, they have done a great job. They offer a nice product and I think all we can do is try to make our products better. A number of the on-demand offerings have improved dramatically. We have something we call [Project Infinity] that has a significant leap forward in the amount of on-demand content from libraries servers. We are very excited about the potential of that technology. But one of the things Netflix does beautifully and others is give you a great way to search what is available and give you recommendations. And that is not so easily done on our electronic program guide today. So we are improving. I think we will improve.Comcast’s Project Infinity was launched in 2008 to offer more content and video on demand. The big lesson from Roberts: Netflix is quite capable of dinging incremental cable revenue and companies like Comcast need to step up. Netflix ended the second quarter with more than 15 million subscribers, up 42 percent from a year ago. In the second quarter, Netflix added more than 1 million subscribers.

Merrick Angle is an English designer/illustrator based in rural France; more specifically, a "crumbly, vine-covered studio near Limoges," as he says. We like his new Minimal Wood Clock, which was "inspired by the fine woodland that surrounds up here at Double Merrick HQ. Crafted by hand from reclaimed Limousin Douglas timber (noted for its orangey red hue), each clock is cut to size, sanded, and then screenprinted with a simple 'Arrow 12' design. Then the clock is dried, waxed, and fitted with a quartz mechanism." Each clock is approximately 44 centimeters in diameter (17.3 inches) and requires a single AA battery; €60 directly from Double Merrick (worldwide shipping available; approximately $20 to the US).

By Lori Ioannou / São Paulo

Marcelo Marzola, the 33-year-old co-founder of Predicta.net, is a perfect example of how hot Brazil's $1.6 trillion economy has become — and why its entrepreneurs are now getting their phone calls returned by venture capitalists after a decade of "You're from where?"

Marzola was invited to present his company's free online behavioral-targeting tool, BTBuckets, at the Google I/O Web-developer conference in San Francisco in May. To get ogled at the Google conference is the goal of any Web developer. Marzola earned rave reviews for creating what has become a de facto standard, used on more than 2,000 websites in 90 countries by such corporate titans as Pfizer, Motorola and Unilever. The product fills an overlooked niche in the industry by allowing websites to segment their users according to their online habits and then direct targeted content and advertising to them in real time. "It has turned the industry on its head, and it's gaining mass recognition," says Daniel Waisberg, an industry consultant and a former chair of marketing of the Web Analytics Association. (See the 50 best websites of 2009.)

The spotlight has attracted about 10 VC firms to Marzola over the past six months. His track record will impress them: the company has been growing at a compound rate of 40% annually since 2005 and has a profit margin of more than 20% on $12 million in revenue. Now he is in the midst of closing a deal with DFJ FIR Capital, a local venture firm with $160 million under management, to raise $15 million to $20 million in exchange for a 35% equity stake to fund his company's expansion efforts. BTBuckets plans to open offices in major markets in Latin America and the U.S.

To Marzola, who had to hustle $80,000 in start-up capital from family and friends, the newfound interest is indicative of a VC power shift from Silicon Valley to developing economies like Brazil's. "Ten years ago, when I launched my business, getting start-up capital was impossible," he says. "At the time, I called on 20 banks, venture-capital and private-equity firms, and everyone turned me down. No one wanted the risk of investing in a fledgling. Finally, there are signs that the equity-capital market for entrepreneurs is igniting."

This is a breakout that thousands of Brazil's newbies have been waiting for. Today there are only about nine players — including Antera, Confrapar, DFJ FIR Capital, Monashees Capital and Status Capital — with an estimated $1.9 billion in assets under management, according to the Latin American Venture Capital Association (LAVCA). These firms are run by trailblazers who have been promoting the merits of entrepreneurship to a Brazilian business community that has been risk-averse and to the government of President Luiz Inácio Lula da Silva, which has been leery of California capitalism. (See pictures of São Paulo.)

Preaching the gospel of Silicon Valley has been missionary work. "Venture capital is a concept just beginning to filter into the public's consciousness," explains Robert Binder, CEO of Antera Gestão de Recursos, an asset-management company established in 2004 that runs the $50 million Criatec Fund, an early-stage equity fund capitalized by BDNES, the Brazilian development bank. For a country with a huge state investment in technology, it's been a surprisingly tough sell. The 123 national institutes of science and 400 incubators scattered across the country are wellsprings of ideas. But only recently have CEOs from private midsize Brazilian corporations been willing to lend a hand to promising upstarts by offering mentoring support and angel finance.

Their timing is understandable. The IMF projects that Brazil's economy — now the eighth largest in the world — will grow by 7.1% this year and soar throughout the decade. A confluence of factors will contribute to growth: abundant natural resources, stable government policies, a sophisticated banking sector, a rapidly growing middle class that now comprises about half the population of 190 million and a surge in real estate and infrastructure development to prepare for Brazil's hosting the 2014 FIFA World Cup and the 2016 Summer Olympics.

The Tech Transformation Another catalyst has been the focus on developing world-class high-tech industries in a variety of sectors — from aerospace, agribusiness and energy to information technology, business-process outsourcing, semiconductors and telecommunications. "The goal is to push the country's exports up the value chain," explains Antonio Gil, president of Brasscom, an association of Brazilian IT and communications companies. He notes that today Brazil can claim 1.7 million IT professionals. This brainpower has helped the country attract top-tier multinationals like IBM, which in June announced it is opening its ninth research center in Brazil and its first in Latin America.

As part of its grand plan, the government is investing heavily in programs that spark homegrown innovation around these key industries. These initiatives — from venture forums to R&D grants — are led by the Financing Agency for Projects and Studies (FINEP), the innovation arm of the Ministry of Science and Technology. "Our country invests 1% of GDP in R&D and leads the region in entrepreneurship," explains FINEP's Eduardo Sette Camara. "Now 15 out of 100 residents are involved in a start-up."

Tiago Lins, business-development director and co-founder of SiliconReef, a company that has developed a microchip that harvests energy from the environment to power mobile devices and wireless networks, has been a prime beneficiary of government support. He and his partner, CEO Marília Lima, incubated their breakthrough technology at CESAR, the country's well-known R&D center and incubator in Recife. Since incorporating two years ago, the duo have raised grants from FINEP to design and test their product, known as EHO1. They are looking to raise an additional $1 million to fund a product launch. "Right now our biggest hurdle is gaining credibility in the international business community," Lins says.

Lins' quest for entrepreneurial success is an aspiration now shared by many young Brazilian mavericks. "Over the last five years, more college graduates have become enamored with the idea of starting their own business," says Michael Nicklas, an angel investor who runs SocialSmart Ventures, based in New York City, and focuses on early-stage Internet ventures in Brazil. "There is a raw-talent pool in the technology sector. The country has one of the strongest Java, open-source and Ruby communities in the world. The fact that the Internet, cloud computing and open-source databases have lowered the capital requirements of launching a tech business has created the opportunity for these webmasters to strike out on their own."

Nicklas has been scouring the countryside — from Belo Horizonte to Curitiba to São Paulo — for three years looking to put his money to work. A serial entrepreneur, he has been impressed with the country's early adoption of social media. That has led him to invest in three upstarts, including Compra3, a company that has developed a unique buying platform for social-media networks that gives users discounts and cash back on purchases and allows them to comment on items. After sinking $150,000 into a 2.5% stake in the business, Nicklas helped founders Bruno Medeiros and Andre Monteiro refine their business plan and prepare for their August road show in the States. The hope is that VCs will dole out $12.5 million in equity finance so the company can consolidate its model in Brazil and break into the North American market. Compra3 already has a partnership with Walmart and 18 Latin American retailers, including Americanas.com. "Nicklas is our bridge to foreign investors, and we need his connections to get to the next level," explains the 29-year-old Medeiros, who has been spawning new businesses with his own money since he was 19. (See 25 websites you can't live without.)

Those connections are key, since there is a huge funding gap in Brazil between seed-financing rounds and the second and third rounds of venture capital critical to growth. Instead, most of the investment capital flows into private-equity funds. There are now more than 30 PE funds, with some $12.3 billion in assets under management, according to LAVCA. These funds — for example, Advent International's $1.65 billion Latin America Private Equity Fund V that closed in May — specialize in large buyouts, M&A and infrastructure projects. But even that capital pool is tiny when you consider that India, a BRIC rival, boasts a private-equity market five times as big.

Against the Odds According to marcus regueira, a former investment banker in the U.S. and founding partner of DFJ FIR Capital, Brazil still suffers from inefficiencies with capital flow and an IPO market that has barriers to entry for small- or medium-size companies. To find liquidity, VCs have to be attuned to the domestic market and know how to figure out strategic partnerships or exit strategies for their portfolio companies.

Another inhibiting factor has been the lack of local expertise on how to operate a private-equity or venture-capital limited partnership. That's why FINEP is taking an active role in training local businesspeople on the ins and outs of being a general partner. Some foreign transplants, like private-equity firm Advent International, do this on their own. They hire top collegiate engineers, send them to U.S. business schools for their MBAs and then groom them to become partners in the firm. Many are even placed as interim CEOs. (Read "The One Country That Might Avoid Recession Is...")

And vestiges of the past remain. Brazil's taxation and regulations are among the most onerous in the world for business. The corporate income tax rate is 34%, and Social Security taxes and other compulsory employee benefits add up to a whopping 80% to 90% of an employee's salary. That's not to mention taxes on bank loans and Brazil's somewhat archaic labor laws.

Considering the challenges, any entrepreneur able to launch a business and survive is part of an elite class. "It takes a superstar who is an astute cash manager from the get-go to win in this market," stresses DFJ FIR Capital's Regueira. "This is economic Darwinism at its best." Gustavo Caetano, the founder and CEO of Samba Tech, a three-year-old company that has created a platform to help third-party developers migrate and distribute video over the Internet, is another survivor. In just three years he built his business with a $100,000 loan from his father into a profitable $7 million-a-year concern with 50 employees. It has been growing at an annual rate of 300%. "In Brazil you need to have a strong payback model right at the beginning. VCs won't wait to see if one day there is an exit for your company since they don't want the risk. In the U.S., a start-up is cut some slack. It can operate for two years without any revenue. We don't have that luxury."

There are signs that times are changing. More overseas venture capitalists interested in diversifying their assets are looking at Brazil. They are being prodded by institutional investors, who for a second consecutive year ranked the country as the second most attractive emerging market (after China) for private-equity investment, according to the 2010 EMPEA/Coller Capital Emerging Markets Private Equity Survey. "A lot of investors feel they are overweighted in Asia and are turning to Brazil," says Alberto Camões, founder and managing partner of Stratus Venture Capital, which is raising a $300 million private-equity fund.

What Brazil needs to turn the trickle of outside funding into a river is a dazzling IPO that generates global buzz and demonstrates the breakthrough thinking and true grit of the Brazilian entrepreneur. The hope among local VCs is that this will happen within the next two years — perhaps to a company like Predicta.net that has so much potential.

The possibilities are legion. Just ask Great Hill Partners in Boston. It took the firm four years to make an 860% return on its investment in BuscaPé, an e-commerce services provider; it sold a 91% stake for $340 million to Naspers, the South African media giant, last September. Nicklas sums it up nicely: "Venture investors run in herds, and when they see fertile ground, they swarm in to stake a claim. Now they have Brazil in their sights."

This article originally appeared in the August 23, 2010 issue of TIME Asia.